| |

Awesome Visualization of Credit Crisis

If you have a hard time wrapping your head around all the terms flying around along with how credit or housing connects with the collapse that's taken place on Wall Street, watch this! Labels: economy, government, money, news

Wacky Tax Write Offs

We're rounding the final countdown for tax season. If you're getting your books squared away this weekend, be sure to read this article on the 9 wackiest tax deductions for 2009 from BankRate.com. Now, these didn't necessarily work, it's just what some taxpayers attempted to write off. For example, one accountant noted a client had a check for over $2,000 written to a gynecologist. It was classified on the business books as 'repairs and maintenance.' Another out-there attempt has been from some animal lovers. The article mentions one pet lover who claimed his dog as a dependent, another who attempted to write off the dog food for his "home security system," and yet another who claimed Fido as a landscaping subcontractor. Got to admit, these are some pretty creative deduction attempts. What's the craziest thing you've ever been able to write off? Click here to read the complete aritcle. Labels: commentary, economy, money

Don't Waste Money on These Things

SmartMoney.com SmartMoney.com has run a story of 7 things that you're wasting money on. Times are tough and we know a lot of you are looking to save a few bucks here and there. So where are you wasting money? The seven places they mention are bottled water, extended warranties, gym memberships, overdraft fees, organic produce, auto insurance, and music downloads. There's definitely money to be saved in each of these and SmartMoney breaks down an estimate of how much money you could save. There are obviously many variables to consider here. Some other items we'd like to add to this list are eating out, coffee runs, entertainment expenses, alcohol and movie rentals. Another thing is to be more thoughtful and plan ahead. For example, if you're going to run errands on the weekend, map out where you need to travel and make sure you take the most direct route. This will save not just time, but gas, which we know is money. Please go on the message boards and share your tips. Labels: advice, economy, money

Don't Waste Money on These Things

SmartMoney.com SmartMoney.com has run a story of 7 things that you're wasting money on. Times are tough and we know a lot of you are looking to save a few bucks here and there. So where are you wasting money? The seven places they mention are bottled water, extended warranties, gym memberships, overdraft fees, organic produce, auto insurance, and music downloads. There's definitely money to be saved in each of these and SmartMoney breaks down an estimate of how much money you could save. There are obviously many variables to consider here. Some other items we'd like to add to this list are eating out, coffee runs, entertainment expenses, alcohol and movie rentals. Another thing is to be more thoughtful and plan ahead. For example, if you're going to run errands on the weekend, map out where you need to travel and make sure you take the most direct route. This will save not just time, but gas, which we know is money. Please go on the message boards and share your tips. Labels: advice, economy, money

Don't Waste Money on These Things

SmartMoney.com SmartMoney.com has run a story of 7 things that you're wasting money on. Times are tough and we know a lot of you are looking to save a few bucks here and there. So where are you wasting money? The seven places they mention are bottled water, extended warranties, gym memberships, overdraft fees, organic produce, auto insurance, and music downloads. There's definitely money to be saved in each of these and SmartMoney breaks down an estimate of how much money you could save. There are obviously many variables to consider here. Some other items we'd like to add to this list are eating out, coffee runs, entertainment expenses, alcohol and movie rentals. Another thing is to be more thoughtful and plan ahead. For example, if you're going to run errands on the weekend, map out where you need to travel and make sure you take the most direct route. This will save not just time, but gas, which we know is money. Please go on the message boards and share your tips. Labels: advice, economy, money

Money Rules for Marriage

Money issues are one of the leading causes of divorce in the country. With money issues crippling the country right now, it's a good time to review the following rules from The Motley Fool. For starters, they say you have to "have the talk." To break the ice they recommend asking, "If you had $50 to burn, what would you spend it on?" Then go into the more difficult financial questions. Another rule is to not ignore financial issues with your ex (if you're remarried). If you had a joint credit card, make sure it's taken care of. With your current spouse, they recommend not feeding each other's bad habits. Who's going to be the party pooper when you both want to purchase a new car, but know that it's not a smart financial decision for you at the moment. It's not all negative talk on money. There are many benefits to being a financial duo. You can save on insurance, get banking deals and more. They also recommend that you get your future financial plan in order. Discuss your goals (short and long term) and then talk about how you're going to get there. Labels: advice, money

Money Rules for Marriage

Money issues are one of the leading causes of divorce in the country. With money issues crippling the country right now, it's a good time to review the following rules from The Motley Fool. For starters, they say you have to "have the talk." To break the ice they recommend asking, "If you had $50 to burn, what would you spend it on?" Then go into the more difficult financial questions. Another rule is to not ignore financial issues with your ex (if you're remarried). If you had a joint credit card, make sure it's taken care of. With your current spouse, they recommend not feeding each other's bad habits. Who's going to be the party pooper when you both want to purchase a new car, but know that it's not a smart financial decision for you at the moment. It's not all negative talk on money. There are many benefits to being a financial duo. You can save on insurance, get banking deals and more. They also recommend that you get your future financial plan in order. Discuss your goals (short and long term) and then talk about how you're going to get there. Labels: advice, money

Money Rules for Marriage

Money issues are one of the leading causes of divorce in the country. With money issues crippling the country right now, it's a good time to review the following rules from The Motley Fool. For starters, they say you have to "have the talk." To break the ice they recommend asking, "If you had $50 to burn, what would you spend it on?" Then go into the more difficult financial questions. Another rule is to not ignore financial issues with your ex (if you're remarried). If you had a joint credit card, make sure it's taken care of. With your current spouse, they recommend not feeding each other's bad habits. Who's going to be the party pooper when you both want to purchase a new car, but know that it's not a smart financial decision for you at the moment. It's not all negative talk on money. There are many benefits to being a financial duo. You can save on insurance, get banking deals and more. They also recommend that you get your future financial plan in order. Discuss your goals (short and long term) and then talk about how you're going to get there. Labels: advice, money

Love After Layoff

When one spouse loses their job, it's not just a financial strain on the marriage, but also an emotional one. A British study released late last year by the Institute for Social and Economic Research at the University of Essex found that couples who experience job loss are more likely to divorce within a year than their employed counterparts. This flies counter to other studies that have said the financial crunch slows divorces because people can't afford them--if nothing else. In this article from MSNBC, Nicholas Yrizarry, a financial planner from Reston, Va., says he sees two types of couples: the ones who are obsessed with money and material things and allow a layoff to destroy their marriage; and the ones who have a mature relationship and adversity only brings them closer. "They are the types that can live in a phone booth together and still be OK," he said. This is a good reminder of what really matters in life. That doesn't mean that money troubles aren't real. Yrizarry offers the following steps couples should take: 1. Sit down "calmly" and discuss what your assets are.

2. Come up with a financial plan to deal with the loss of income and strategies to get a new job--or have a non-working spouse get a job. Assess your options for taking on temporary work or retraining if your skills are not marketable anymore.

3. Implement the plan. On the emotional front, he recommends being respectful and supportive of each other and making sure not to play the "blame game." It's a time to be constructive and supportive, especially in troubled times. Labels: advice, economy, money, real people

Love After Layoff

When one spouse loses their job, it's not just a financial strain on the marriage, but also an emotional one. A British study released late last year by the Institute for Social and Economic Research at the University of Essex found that couples who experience job loss are more likely to divorce within a year than their employed counterparts. This flies counter to other studies that have said the financial crunch slows divorces because people can't afford them--if nothing else. In this article from MSNBC, Nicholas Yrizarry, a financial planner from Reston, Va., says he sees two types of couples: the ones who are obsessed with money and material things and allow a layoff to destroy their marriage; and the ones who have a mature relationship and adversity only brings them closer. "They are the types that can live in a phone booth together and still be OK," he said. This is a good reminder of what really matters in life. That doesn't mean that money troubles aren't real. Yrizarry offers the following steps couples should take: 1. Sit down "calmly" and discuss what your assets are.

2. Come up with a financial plan to deal with the loss of income and strategies to get a new job--or have a non-working spouse get a job. Assess your options for taking on temporary work or retraining if your skills are not marketable anymore.

3. Implement the plan. On the emotional front, he recommends being respectful and supportive of each other and making sure not to play the "blame game." It's a time to be constructive and supportive, especially in troubled times. Labels: advice, economy, money, real people

Love After Layoff

When one spouse loses their job, it's not just a financial strain on the marriage, but also an emotional one. A British study released late last year by the Institute for Social and Economic Research at the University of Essex found that couples who experience job loss are more likely to divorce within a year than their employed counterparts. This flies counter to other studies that have said the financial crunch slows divorces because people can't afford them--if nothing else. In this article from MSNBC, Nicholas Yrizarry, a financial planner from Reston, Va., says he sees two types of couples: the ones who are obsessed with money and material things and allow a layoff to destroy their marriage; and the ones who have a mature relationship and adversity only brings them closer. "They are the types that can live in a phone booth together and still be OK," he said. This is a good reminder of what really matters in life. That doesn't mean that money troubles aren't real. Yrizarry offers the following steps couples should take: 1. Sit down "calmly" and discuss what your assets are.

2. Come up with a financial plan to deal with the loss of income and strategies to get a new job--or have a non-working spouse get a job. Assess your options for taking on temporary work or retraining if your skills are not marketable anymore.

3. Implement the plan. On the emotional front, he recommends being respectful and supportive of each other and making sure not to play the "blame game." It's a time to be constructive and supportive, especially in troubled times. Labels: advice, economy, money, real people

Economy Good for Therapists Bad for Mental Health

USA Today USA Today is reporting that as the economy unravels, so is the mental health of U.S. citizens. "I've never seen this level of anxiety and depression in 22 years of practice," says Nancy Molitor, a psychologist in Wilmette, Ill. "The mental health fallout has been far worse than after 9/11." The article reports a staggering 40% jump in the demand for therapists from June to December. So what are we supposed to do? Unfortunately there are no easy answers and if professional help may be the best option. Psychologist Salvatore Maddi of University of California, Irvine suggests there are three qualities of those who are able to maintain their emotional health in these tough times. Maddi says these "hardy people" stayed committed to what they were doing; they didn't back off or become alienated. They also sought control, trying to influence what happened to them, looking at every avenue for solutions. They saw stressful changes as inevitable and took them as a challenge, an opportunity to grow. Labels: family, health, money, news

Economy Good for Therapists Bad for Mental Health

USA Today USA Today is reporting that as the economy unravels, so is the mental health of U.S. citizens. "I've never seen this level of anxiety and depression in 22 years of practice," says Nancy Molitor, a psychologist in Wilmette, Ill. "The mental health fallout has been far worse than after 9/11." The article reports a staggering 40% jump in the demand for therapists from June to December. So what are we supposed to do? Unfortunately there are no easy answers and if professional help may be the best option. Psychologist Salvatore Maddi of University of California, Irvine suggests there are three qualities of those who are able to maintain their emotional health in these tough times. Maddi says these "hardy people" stayed committed to what they were doing; they didn't back off or become alienated. They also sought control, trying to influence what happened to them, looking at every avenue for solutions. They saw stressful changes as inevitable and took them as a challenge, an opportunity to grow. Labels: family, health, money, news

Economy Good for Therapists Bad for Mental Health

USA Today USA Today is reporting that as the economy unravels, so is the mental health of U.S. citizens. "I've never seen this level of anxiety and depression in 22 years of practice," says Nancy Molitor, a psychologist in Wilmette, Ill. "The mental health fallout has been far worse than after 9/11." The article reports a staggering 40% jump in the demand for therapists from June to December. So what are we supposed to do? Unfortunately there are no easy answers and if professional help may be the best option. Psychologist Salvatore Maddi of University of California, Irvine suggests there are three qualities of those who are able to maintain their emotional health in these tough times. Maddi says these "hardy people" stayed committed to what they were doing; they didn't back off or become alienated. They also sought control, trying to influence what happened to them, looking at every avenue for solutions. They saw stressful changes as inevitable and took them as a challenge, an opportunity to grow. Labels: family, health, money, news

Couple Gets Cash and Jail Time for Bank Error

Pennsylvania couple Randy Pratt, 50, and Melissa Pratt, 36, are now in jail because they cashed out over $175,000 when the bank messed up on where to put the decimal point. Randy is a roofing installer and deposited a check for $1,772.50, but when they read their statement, it showed a deposit of $177,250. They Pratts didn't call the bank and report the error when it occurred last summer. Instead, the couple withdrew the money, quit their jobs and moved to Florida. They were tracked down when they were attempting to buy a house in the Orlando. When questioned by police, Melissa said her husband often got large checks and that she wasn't aware of any error. No wonder the banks need a bailout! What's the most amount of money you've "stumbled upon?" Labels: money, news, real people

Couple Gets Cash and Jail Time for Bank Error

Pennsylvania couple Randy Pratt, 50, and Melissa Pratt, 36, are now in jail because they cashed out over $175,000 when the bank messed up on where to put the decimal point. Randy is a roofing installer and deposited a check for $1,772.50, but when they read their statement, it showed a deposit of $177,250. They Pratts didn't call the bank and report the error when it occurred last summer. Instead, the couple withdrew the money, quit their jobs and moved to Florida. They were tracked down when they were attempting to buy a house in the Orlando. When questioned by police, Melissa said her husband often got large checks and that she wasn't aware of any error. No wonder the banks need a bailout! What's the most amount of money you've "stumbled upon?" Labels: money, news, real people

Couple Gets Cash and Jail Time for Bank Error

Pennsylvania couple Randy Pratt, 50, and Melissa Pratt, 36, are now in jail because they cashed out over $175,000 when the bank messed up on where to put the decimal point. Randy is a roofing installer and deposited a check for $1,772.50, but when they read their statement, it showed a deposit of $177,250. They Pratts didn't call the bank and report the error when it occurred last summer. Instead, the couple withdrew the money, quit their jobs and moved to Florida. They were tracked down when they were attempting to buy a house in the Orlando. When questioned by police, Melissa said her husband often got large checks and that she wasn't aware of any error. No wonder the banks need a bailout! What's the most amount of money you've "stumbled upon?" Labels: money, news, real people

Financial Marriages

It's not uncommon for couples to stay married for the sake of their kids, but it seems there's a growing trend of couples who are staying hitched because of finances. An article in the Phoenix Examiner discusses how couples who don't have kids remain in the same home because of their shared mortgage, car payments and other cost-of-living expenses. One woman said: “We were married thirty years before we decided to live separate lives. I was all for a divorce and so was he but our accountant gave us two financial scenarios. Divorced, we would lose money. By staying together, we got to keep more of our funds and our health insurance coverage as a married couple.” One marriage therapist in the article says that separated couples living together is more common than people realize. This is why statistical data is so tricky because you can also make the argument that there are couples out there who have been living together for many years who share assets, etc. who aren't married. So are hollow marriages still "marriages"? What are your thoughts? Labels: commentary, money, real people, work

Financial Marriages

It's not uncommon for couples to stay married for the sake of their kids, but it seems there's a growing trend of couples who are staying hitched because of finances. An article in the Phoenix Examiner discusses how couples who don't have kids remain in the same home because of their shared mortgage, car payments and other cost-of-living expenses. One woman said: “We were married thirty years before we decided to live separate lives. I was all for a divorce and so was he but our accountant gave us two financial scenarios. Divorced, we would lose money. By staying together, we got to keep more of our funds and our health insurance coverage as a married couple.” One marriage therapist in the article says that separated couples living together is more common than people realize. This is why statistical data is so tricky because you can also make the argument that there are couples out there who have been living together for many years who share assets, etc. who aren't married. So are hollow marriages still "marriages"? What are your thoughts? Labels: commentary, money, real people, work

Financial Marriages

It's not uncommon for couples to stay married for the sake of their kids, but it seems there's a growing trend of couples who are staying hitched because of finances. An article in the Phoenix Examiner discusses how couples who don't have kids remain in the same home because of their shared mortgage, car payments and other cost-of-living expenses. One woman said: “We were married thirty years before we decided to live separate lives. I was all for a divorce and so was he but our accountant gave us two financial scenarios. Divorced, we would lose money. By staying together, we got to keep more of our funds and our health insurance coverage as a married couple.” One marriage therapist in the article says that separated couples living together is more common than people realize. This is why statistical data is so tricky because you can also make the argument that there are couples out there who have been living together for many years who share assets, etc. who aren't married. So are hollow marriages still "marriages"? What are your thoughts? Labels: commentary, money, real people, work

Poor Get Poorer

Talk about rubbing salt in the wound. Earlier this month, the FDIC reported that bank overdraft fees of up to $38 were disproportionately affecting young and low-income consumers. Perhaps that's not too surprising. What is interesting is that nearly half of consumers pay overdraft fees each year. Also found was that large banks are more likely to process transactions from largest to smallest dollar amount, often triggering more fees. Seems like dirty banking tricks. In total, overdraft-related fees bring in $17.5 billion each year to banks and credit unions according to the Center for Responsible Lending. Be careful this holiday season and watch your bank account, you can be sure the banks are looking for a way to make some money. Click here to read the complete article. Labels: money, news

Poor Get Poorer

Talk about rubbing salt in the wound. Earlier this month, the FDIC reported that bank overdraft fees of up to $38 were disproportionately affecting young and low-income consumers. Perhaps that's not too surprising. What is interesting is that nearly half of consumers pay overdraft fees each year. Also found was that large banks are more likely to process transactions from largest to smallest dollar amount, often triggering more fees. Seems like dirty banking tricks. In total, overdraft-related fees bring in $17.5 billion each year to banks and credit unions according to the Center for Responsible Lending. Be careful this holiday season and watch your bank account, you can be sure the banks are looking for a way to make some money. Click here to read the complete article. Labels: money, news

Poor Get Poorer

Talk about rubbing salt in the wound. Earlier this month, the FDIC reported that bank overdraft fees of up to $38 were disproportionately affecting young and low-income consumers. Perhaps that's not too surprising. What is interesting is that nearly half of consumers pay overdraft fees each year. Also found was that large banks are more likely to process transactions from largest to smallest dollar amount, often triggering more fees. Seems like dirty banking tricks. In total, overdraft-related fees bring in $17.5 billion each year to banks and credit unions according to the Center for Responsible Lending. Be careful this holiday season and watch your bank account, you can be sure the banks are looking for a way to make some money. Click here to read the complete article. Labels: money, news

'Nagging' Wife Prompts Husband to Buy Winning Lottery Ticket

A young New Zealand couple won the jackpot of $4.2 million A young New Zealand couple won the jackpot of $4.2 million after the husband rushed into the store to purchase the ticket two minutes before the ticket sales closed. The husband says his wife was nagging him all week to buy one so when he say the Lotto sign in the window, he sprinted in the store to make the purchase at the last minute on a Saturday night. On Sunday, the wife asked her husband to go to the store and pick up some sausage. When the husband arrived, he realized he didn't have enough money so he looked in the paper to see if he won a few bucks. Sure enough, the couple won the grand prize. When he returned home to show his wife, she replied, "but all I wanted was a sausage." What's the most amount of money you've won? Labels: money, real people

'Nagging' Wife Prompts Husband to Buy Winning Lottery Ticket

A young New Zealand couple won the jackpot of $4.2 million A young New Zealand couple won the jackpot of $4.2 million after the husband rushed into the store to purchase the ticket two minutes before the ticket sales closed. The husband says his wife was nagging him all week to buy one so when he say the Lotto sign in the window, he sprinted in the store to make the purchase at the last minute on a Saturday night. On Sunday, the wife asked her husband to go to the store and pick up some sausage. When the husband arrived, he realized he didn't have enough money so he looked in the paper to see if he won a few bucks. Sure enough, the couple won the grand prize. When he returned home to show his wife, she replied, "but all I wanted was a sausage." What's the most amount of money you've won? Labels: money, real people

'Nagging' Wife Prompts Husband to Buy Winning Lottery Ticket

A young New Zealand couple won the jackpot of $4.2 million A young New Zealand couple won the jackpot of $4.2 million after the husband rushed into the store to purchase the ticket two minutes before the ticket sales closed. The husband says his wife was nagging him all week to buy one so when he say the Lotto sign in the window, he sprinted in the store to make the purchase at the last minute on a Saturday night. On Sunday, the wife asked her husband to go to the store and pick up some sausage. When the husband arrived, he realized he didn't have enough money so he looked in the paper to see if he won a few bucks. Sure enough, the couple won the grand prize. When he returned home to show his wife, she replied, "but all I wanted was a sausage." What's the most amount of money you've won? Labels: money, real people

Do You Tell Your Kids About the Economy?

Today's youth have never seen an economic slump. Heck, with the drop in the economy we've seen these past few months, only those who are old enough to remember the Great Depression have (like our money expert Al Jacobs). Anyway, now that the holidays are here and many kids probably aren't going to have as many gifts as in years past, what's a parent to do? This article on MSNBC says that many parents are spending less on themselves to shield their kids from financial hardships. One family with sons ages 10, 8 and 4, had their kids go through the advertising circulars and circle their holiday wish list. They then had their kids ad up the total of all the items they wished for. One child was surprised that his list came to $904, which was a perfect segue to discuss money with them. In conclusion, the article didn't offer any concrete advice, but I thought the last bit about the sons was a neat idea. How are you approaching the money situation in your household? Are you shielding your kids or shedding a light on the real world? Labels: advice, kids, money

Do You Tell Your Kids About the Economy?

Today's youth have never seen an economic slump. Heck, with the drop in the economy we've seen these past few months, only those who are old enough to remember the Great Depression have (like our money expert Al Jacobs). Anyway, now that the holidays are here and many kids probably aren't going to have as many gifts as in years past, what's a parent to do? This article on MSNBC says that many parents are spending less on themselves to shield their kids from financial hardships. One family with sons ages 10, 8 and 4, had their kids go through the advertising circulars and circle their holiday wish list. They then had their kids ad up the total of all the items they wished for. One child was surprised that his list came to $904, which was a perfect segue to discuss money with them. In conclusion, the article didn't offer any concrete advice, but I thought the last bit about the sons was a neat idea. How are you approaching the money situation in your household? Are you shielding your kids or shedding a light on the real world? Labels: advice, kids, money

Do You Tell Your Kids About the Economy?

Today's youth have never seen an economic slump. Heck, with the drop in the economy we've seen these past few months, only those who are old enough to remember the Great Depression have (like our money expert Al Jacobs). Anyway, now that the holidays are here and many kids probably aren't going to have as many gifts as in years past, what's a parent to do? This article on MSNBC says that many parents are spending less on themselves to shield their kids from financial hardships. One family with sons ages 10, 8 and 4, had their kids go through the advertising circulars and circle their holiday wish list. They then had their kids ad up the total of all the items they wished for. One child was surprised that his list came to $904, which was a perfect segue to discuss money with them. In conclusion, the article didn't offer any concrete advice, but I thought the last bit about the sons was a neat idea. How are you approaching the money situation in your household? Are you shielding your kids or shedding a light on the real world? Labels: advice, kids, money

12 Days of Christmas Costs $86,609

Every year PNC Wealth Management compiles a "Christmas Price Index," which rings up the total costs from the first day of Christmas's partridge in a pear tree to the 12 drummers drumming, purchased repeatedly as the song suggests. Last year, the total was was $78,100. This year the total jumped 10.9 percent to $86,609, an increase of $8,508. Interestingly, the five gold rings is down to $350 from $395 last year and many of the birds are cheaper (french hens, turtle doves, geese a-laying). This seems like just good holiday fodder, but these prices are a telling barometer of our current economic conditions. For example, gasoline increases have driven up shipping costs resulting in the pear tree price increase of $5. The aforementioned bird drops reflect the decrease in food prices. While the increase in the price of "swans a swimming" reflect in the pricing increase of luxury items. Click here to read the full article, including how to purchase these items on the cheap (Riverdance DVD instead of "lords a-leaping". Here's a breakdown of the costs and their comparison to last year: Partridge, $20 (last year: $15) Pear Tree, $200 (last year: $150) Two Turtle Doves, $55 (last year: $40) Three French Hens, $30 (last year: $45) Four Calling Birds (canaries), $600 (last year: same) Five Gold Rings, $350 (last year: $395) Six Geese a-Laying, $240 (last year: $360) Seven Swans a-Swimming, $5,600 (last year: $4,200) Eight Maids a-Milking, $52 (last year: $47) Nine Ladies Dancing (per performance), $4,759 (last year: same) 10 Lords a-Leaping (per performance), $4,414 (last year: $4,285) 11 Pipers Piping (per performance), $2,285 (last year: $2,213) 12 Drummers Drumming (per performance), $2,475 (last year: $2,398) Labels: entertainment, holidays, money, study

12 Days of Christmas Costs $86,609

Every year PNC Wealth Management compiles a "Christmas Price Index," which rings up the total costs from the first day of Christmas's partridge in a pear tree to the 12 drummers drumming, purchased repeatedly as the song suggests. Last year, the total was was $78,100. This year the total jumped 10.9 percent to $86,609, an increase of $8,508. Interestingly, the five gold rings is down to $350 from $395 last year and many of the birds are cheaper (french hens, turtle doves, geese a-laying). This seems like just good holiday fodder, but these prices are a telling barometer of our current economic conditions. For example, gasoline increases have driven up shipping costs resulting in the pear tree price increase of $5. The aforementioned bird drops reflect the decrease in food prices. While the increase in the price of "swans a swimming" reflect in the pricing increase of luxury items. Click here to read the full article, including how to purchase these items on the cheap (Riverdance DVD instead of "lords a-leaping". Here's a breakdown of the costs and their comparison to last year: Partridge, $20 (last year: $15) Pear Tree, $200 (last year: $150) Two Turtle Doves, $55 (last year: $40) Three French Hens, $30 (last year: $45) Four Calling Birds (canaries), $600 (last year: same) Five Gold Rings, $350 (last year: $395) Six Geese a-Laying, $240 (last year: $360) Seven Swans a-Swimming, $5,600 (last year: $4,200) Eight Maids a-Milking, $52 (last year: $47) Nine Ladies Dancing (per performance), $4,759 (last year: same) 10 Lords a-Leaping (per performance), $4,414 (last year: $4,285) 11 Pipers Piping (per performance), $2,285 (last year: $2,213) 12 Drummers Drumming (per performance), $2,475 (last year: $2,398) Labels: entertainment, holidays, money, study

12 Days of Christmas Costs $86,609

Every year PNC Wealth Management compiles a "Christmas Price Index," which rings up the total costs from the first day of Christmas's partridge in a pear tree to the 12 drummers drumming, purchased repeatedly as the song suggests. Last year, the total was was $78,100. This year the total jumped 10.9 percent to $86,609, an increase of $8,508. Interestingly, the five gold rings is down to $350 from $395 last year and many of the birds are cheaper (french hens, turtle doves, geese a-laying). This seems like just good holiday fodder, but these prices are a telling barometer of our current economic conditions. For example, gasoline increases have driven up shipping costs resulting in the pear tree price increase of $5. The aforementioned bird drops reflect the decrease in food prices. While the increase in the price of "swans a swimming" reflect in the pricing increase of luxury items. Click here to read the full article, including how to purchase these items on the cheap (Riverdance DVD instead of "lords a-leaping". Here's a breakdown of the costs and their comparison to last year: Partridge, $20 (last year: $15) Pear Tree, $200 (last year: $150) Two Turtle Doves, $55 (last year: $40) Three French Hens, $30 (last year: $45) Four Calling Birds (canaries), $600 (last year: same) Five Gold Rings, $350 (last year: $395) Six Geese a-Laying, $240 (last year: $360) Seven Swans a-Swimming, $5,600 (last year: $4,200) Eight Maids a-Milking, $52 (last year: $47) Nine Ladies Dancing (per performance), $4,759 (last year: same) 10 Lords a-Leaping (per performance), $4,414 (last year: $4,285) 11 Pipers Piping (per performance), $2,285 (last year: $2,213) 12 Drummers Drumming (per performance), $2,475 (last year: $2,398) Labels: entertainment, holidays, money, study

One Couple's Cost Cutting Tips

We know times are tough...the market tumbled again a few hundred points today. If you're looking to save money here and there, check out the daily habits of this couple, which include unplugging all the electric devices in their home every morning before going to work. What have you done to save money? Labels: advice, money

One Couple's Cost Cutting Tips

We know times are tough...the market tumbled again a few hundred points today. If you're looking to save money here and there, check out the daily habits of this couple, which include unplugging all the electric devices in their home every morning before going to work. What have you done to save money? Labels: advice, money

One Couple's Cost Cutting Tips

We know times are tough...the market tumbled again a few hundred points today. If you're looking to save money here and there, check out the daily habits of this couple, which include unplugging all the electric devices in their home every morning before going to work. What have you done to save money? Labels: advice, money

What to Do With Your Money

Are you a deer in headlights when it comes to your money in the market? You probably feel like the rodent that's been run over. Regardless, Newsweek offers some advice. It says to put your money back into the market--as much as you can--really. Their logic is that over the long haul, the market will go up. Here are some more specific bits of advice: Put your money in a Roth IRA"You'll pay income taxes on the amount you convert, but that amount is probably a lot lower than it would have been without the recent market rout. And given the astronomical deficits that Washington will have to fix sooner or later, your tax rate may be at an all-time low. Once your money is in a Roth, you'll be able to reap all the future earnings without paying taxes on them." Invest for income. "High-yield stocks and corporate bonds have been among the hardest hit in recent market sell-offs, but they are exactly what you want in your portfolio as you head into retirement" Use a health savings account.The theory behind these is that they enable you to save up to your deductible without paying taxes on it... For 2008, you can contribute $5,800 and an additional $900 in catch-up contributions if you're 55 or older." What have you done with your money, anything? Labels: advice, money

What to Do With Your Money

Are you a deer in headlights when it comes to your money in the market? You probably feel like the rodent that's been run over. Regardless, Newsweek offers some advice. It says to put your money back into the market--as much as you can--really. Their logic is that over the long haul, the market will go up. Here are some more specific bits of advice: Put your money in a Roth IRA"You'll pay income taxes on the amount you convert, but that amount is probably a lot lower than it would have been without the recent market rout. And given the astronomical deficits that Washington will have to fix sooner or later, your tax rate may be at an all-time low. Once your money is in a Roth, you'll be able to reap all the future earnings without paying taxes on them." Invest for income. "High-yield stocks and corporate bonds have been among the hardest hit in recent market sell-offs, but they are exactly what you want in your portfolio as you head into retirement" Use a health savings account.The theory behind these is that they enable you to save up to your deductible without paying taxes on it... For 2008, you can contribute $5,800 and an additional $900 in catch-up contributions if you're 55 or older." What have you done with your money, anything? Labels: advice, money

What to Do With Your Money

Are you a deer in headlights when it comes to your money in the market? You probably feel like the rodent that's been run over. Regardless, Newsweek offers some advice. It says to put your money back into the market--as much as you can--really. Their logic is that over the long haul, the market will go up. Here are some more specific bits of advice: Put your money in a Roth IRA"You'll pay income taxes on the amount you convert, but that amount is probably a lot lower than it would have been without the recent market rout. And given the astronomical deficits that Washington will have to fix sooner or later, your tax rate may be at an all-time low. Once your money is in a Roth, you'll be able to reap all the future earnings without paying taxes on them." Invest for income. "High-yield stocks and corporate bonds have been among the hardest hit in recent market sell-offs, but they are exactly what you want in your portfolio as you head into retirement" Use a health savings account.The theory behind these is that they enable you to save up to your deductible without paying taxes on it... For 2008, you can contribute $5,800 and an additional $900 in catch-up contributions if you're 55 or older." What have you done with your money, anything? Labels: advice, money

Don't Count on Holiday Bonuses

It may be a little early talking about the holidays, but they are just around the corner. And with the economy going crazy like it has, it's worth planning now than get stuck on December 24th with no bonus check for relief. The AP just came out with a story saying that many who are expecting and have received year-end or holiday bonuses in the past shouldn't expect to get them this year. Obviously if the company you work for is doing well and has been doing well, you may not have anything to worry about. Then again, they may be planning for rougher waters ahead. Either way, here's your friendly reminder that it's not wise to plan on non-guaranteed money. Labels: advice, holidays, money, news

Don't Count on Holiday Bonuses

It may be a little early talking about the holidays, but they are just around the corner. And with the economy going crazy like it has, it's worth planning now than get stuck on December 24th with no bonus check for relief. The AP just came out with a story saying that many who are expecting and have received year-end or holiday bonuses in the past shouldn't expect to get them this year. Obviously if the company you work for is doing well and has been doing well, you may not have anything to worry about. Then again, they may be planning for rougher waters ahead. Either way, here's your friendly reminder that it's not wise to plan on non-guaranteed money. Labels: advice, holidays, money, news

Don't Count on Holiday Bonuses

It may be a little early talking about the holidays, but they are just around the corner. And with the economy going crazy like it has, it's worth planning now than get stuck on December 24th with no bonus check for relief. The AP just came out with a story saying that many who are expecting and have received year-end or holiday bonuses in the past shouldn't expect to get them this year. Obviously if the company you work for is doing well and has been doing well, you may not have anything to worry about. Then again, they may be planning for rougher waters ahead. Either way, here's your friendly reminder that it's not wise to plan on non-guaranteed money. Labels: advice, holidays, money, news

60 Minutes Explains Wall Street Crash

It's difficult to make out the connection and jargon of the financial collapse on Wall Street, but 60 Minutes has a great 12 minute video that helps explain how our economy got into this situation. It's likely that just about all Americans will feel the effects of the current crash, if not immediately, perhaps when they look at their portfolio in six months and see how it's disappearing. How have you been effected? Labels: money, news, TV

60 Minutes Explains Wall Street Crash

It's difficult to make out the connection and jargon of the financial collapse on Wall Street, but 60 Minutes has a great 12 minute video that helps explain how our economy got into this situation. It's likely that just about all Americans will feel the effects of the current crash, if not immediately, perhaps when they look at their portfolio in six months and see how it's disappearing. How have you been effected? Labels: money, news, TV

60 Minutes Explains Wall Street Crash

It's difficult to make out the connection and jargon of the financial collapse on Wall Street, but 60 Minutes has a great 12 minute video that helps explain how our economy got into this situation. It's likely that just about all Americans will feel the effects of the current crash, if not immediately, perhaps when they look at their portfolio in six months and see how it's disappearing. How have you been effected? Labels: money, news, TV

Women Rule the Home

A new study from the Pew Research Center A new study from the Pew Research Center found that when it comes to the home, women are in control and that's fine by men. When it comes to planning weekend activities, household finances, major home purchases and TV watching, women not men are the ones pulling the strings--making 43 percent of the decisions. That's more than double who said the man makes the decision (26 percent). The other 31 percent said the decisions we equally divided. In the scenario where women make the decision, men don't have the final say and say they either consult or just defer to what the woman wants. What's interesting is that older couples who were surveyed said they were more likely to share in the decision-making process than their younger counterparts. Who makes the decisions in your home? Labels: money, study, women

Women Rule the Home

A new study from the Pew Research Center A new study from the Pew Research Center found that when it comes to the home, women are in control and that's fine by men. When it comes to planning weekend activities, household finances, major home purchases and TV watching, women not men are the ones pulling the strings--making 43 percent of the decisions. That's more than double who said the man makes the decision (26 percent). The other 31 percent said the decisions we equally divided. In the scenario where women make the decision, men don't have the final say and say they either consult or just defer to what the woman wants. What's interesting is that older couples who were surveyed said they were more likely to share in the decision-making process than their younger counterparts. Who makes the decisions in your home? Labels: money, study, women

Women Rule the Home

A new study from the Pew Research Center A new study from the Pew Research Center found that when it comes to the home, women are in control and that's fine by men. When it comes to planning weekend activities, household finances, major home purchases and TV watching, women not men are the ones pulling the strings--making 43 percent of the decisions. That's more than double who said the man makes the decision (26 percent). The other 31 percent said the decisions we equally divided. In the scenario where women make the decision, men don't have the final say and say they either consult or just defer to what the woman wants. What's interesting is that older couples who were surveyed said they were more likely to share in the decision-making process than their younger counterparts. Who makes the decisions in your home? Labels: money, study, women

Do You Pay Your Kids for Good Grades?

USA Today USA Today interviewed several CEOs asking them their thoughts on giving their kids cash for grades and whether or not they thought it was a good idea. In the end, the majority of CEOs interviewed did think it was a good idea while half actually did pay their kids for good grades. In contrast, only 15% of 450 high school principals surveyed thought paying for grades was a good idea. CEOs see pay for performance as more art than science, much like keeping employees motivated to do good work. What are your thoughts? Do you pay your kids for grades? Are there any teachers out there? What are your thoughts on this subject? Labels: kids, money, study, work

Do You Pay Your Kids for Good Grades?

USA Today USA Today interviewed several CEOs asking them their thoughts on giving their kids cash for grades and whether or not they thought it was a good idea. In the end, the majority of CEOs interviewed did think it was a good idea while half actually did pay their kids for good grades. In contrast, only 15% of 450 high school principals surveyed thought paying for grades was a good idea. CEOs see pay for performance as more art than science, much like keeping employees motivated to do good work. What are your thoughts? Do you pay your kids for grades? Are there any teachers out there? What are your thoughts on this subject? Labels: kids, money, study, work

Do You Pay Your Kids for Good Grades?

USA Today USA Today interviewed several CEOs asking them their thoughts on giving their kids cash for grades and whether or not they thought it was a good idea. In the end, the majority of CEOs interviewed did think it was a good idea while half actually did pay their kids for good grades. In contrast, only 15% of 450 high school principals surveyed thought paying for grades was a good idea. CEOs see pay for performance as more art than science, much like keeping employees motivated to do good work. What are your thoughts? Do you pay your kids for grades? Are there any teachers out there? What are your thoughts on this subject? Labels: kids, money, study, work

Young Workers Aren't Good With Savings

Fidelity Investments released a survey Fidelity Investments released a survey that says half of Gen X and Gen Y workers said saving for retirement is an obligation or a goal, but 51 percent said other financial priorities prevent them from setting aside money. The survey also suggests that these two groups of workers will switch jobs around seven times and many of them cash out their 401(k)s when the change jobs. The survey says a whopping 56 percent cashed out their work place savings plans and 41 percent said they didn’t seek financial advice when changing jobs. Are you comfortable with the way your financial retirement is heading? Any questions you want our experts to answer? Labels: money, study

Young Workers Aren't Good With Savings

Fidelity Investments released a survey Fidelity Investments released a survey that says half of Gen X and Gen Y workers said saving for retirement is an obligation or a goal, but 51 percent said other financial priorities prevent them from setting aside money. The survey also suggests that these two groups of workers will switch jobs around seven times and many of them cash out their 401(k)s when the change jobs. The survey says a whopping 56 percent cashed out their work place savings plans and 41 percent said they didn’t seek financial advice when changing jobs. Are you comfortable with the way your financial retirement is heading? Any questions you want our experts to answer? Labels: money, study

Young Workers Aren't Good With Savings

Fidelity Investments released a survey Fidelity Investments released a survey that says half of Gen X and Gen Y workers said saving for retirement is an obligation or a goal, but 51 percent said other financial priorities prevent them from setting aside money. The survey also suggests that these two groups of workers will switch jobs around seven times and many of them cash out their 401(k)s when the change jobs. The survey says a whopping 56 percent cashed out their work place savings plans and 41 percent said they didn’t seek financial advice when changing jobs. Are you comfortable with the way your financial retirement is heading? Any questions you want our experts to answer? Labels: money, study

The Value of Your Life has Dropped Nearly $1 Million

The Environmental Protection Agency The Environmental Protection Agency dropped the "value of a statistical life" to $6.9 million -- a drop of $900,000 from five years ago. So why would the U.S. government devalue the life of Americans? The AP summates that "government agencies put a value on human life and then weigh the costs versus the lifesaving benefits of a proposed rule. The less a life is worth to the government, the less the need for a regulation, such as tighter restrictions on pollution." The article also goes on to say that "the value based on what people are willing to pay to avoid certain risks, and on how much extra employers pay their workers to take on additional risks. Most of the data is drawn from payroll statistics; some comes from opinion surveys. If you had to put a price tag on your life and where you are today compared to five years ago, would you be worth more? Labels: health, money, study

The Value of Your Life has Dropped Nearly $1 Million

The Environmental Protection Agency The Environmental Protection Agency dropped the "value of a statistical life" to $6.9 million -- a drop of $900,000 from five years ago. So why would the U.S. government devalue the life of Americans? The AP summates that "government agencies put a value on human life and then weigh the costs versus the lifesaving benefits of a proposed rule. The less a life is worth to the government, the less the need for a regulation, such as tighter restrictions on pollution." The article also goes on to say that "the value based on what people are willing to pay to avoid certain risks, and on how much extra employers pay their workers to take on additional risks. Most of the data is drawn from payroll statistics; some comes from opinion surveys. If you had to put a price tag on your life and where you are today compared to five years ago, would you be worth more? Labels: health, money, study

The Value of Your Life has Dropped Nearly $1 Million

The Environmental Protection Agency The Environmental Protection Agency dropped the "value of a statistical life" to $6.9 million -- a drop of $900,000 from five years ago. So why would the U.S. government devalue the life of Americans? The AP summates that "government agencies put a value on human life and then weigh the costs versus the lifesaving benefits of a proposed rule. The less a life is worth to the government, the less the need for a regulation, such as tighter restrictions on pollution." The article also goes on to say that "the value based on what people are willing to pay to avoid certain risks, and on how much extra employers pay their workers to take on additional risks. Most of the data is drawn from payroll statistics; some comes from opinion surveys. If you had to put a price tag on your life and where you are today compared to five years ago, would you be worth more? Labels: health, money, study

Home Sale Can Put Strain on Marriage

A Wall Street Journal editor, Neal Templin discusses the process of selling his home and how it put a strain on his marriage. They argued about how much to spend fixing up the house and how quickly they should drop the price when their home wouldn't sell. Neal's wife Clarissa wanted to hold out for a higher price while Neal wanted to get the price down as quickly as possible and get the house sold immediately. In addition, Clarissa wanted to do much more remodeling and prepping than Neal did. They compromised and wound up spending $2,000 on granite countertops and a new sink in the kitchen, plus paint for the bathrooms. Then more money was spent: on plants, a mantle, light fixtures and more. Eventually they sold the house, but not after a lot of compromising and negotiating with each other. Have you and your spouse argued over your housing situation recently? What did you argue about and was their a resolution? Labels: commentary, money, real people, work

Home Sale Can Put Strain on Marriage

A Wall Street Journal editor, Neal Templin discusses the process of selling his home and how it put a strain on his marriage. They argued about how much to spend fixing up the house and how quickly they should drop the price when their home wouldn't sell. Neal's wife Clarissa wanted to hold out for a higher price while Neal wanted to get the price down as quickly as possible and get the house sold immediately. In addition, Clarissa wanted to do much more remodeling and prepping than Neal did. They compromised and wound up spending $2,000 on granite countertops and a new sink in the kitchen, plus paint for the bathrooms. Then more money was spent: on plants, a mantle, light fixtures and more. Eventually they sold the house, but not after a lot of compromising and negotiating with each other. Have you and your spouse argued over your housing situation recently? What did you argue about and was their a resolution? Labels: commentary, money, real people, work

Home Sale Can Put Strain on Marriage

A Wall Street Journal editor, Neal Templin discusses the process of selling his home and how it put a strain on his marriage. They argued about how much to spend fixing up the house and how quickly they should drop the price when their home wouldn't sell. Neal's wife Clarissa wanted to hold out for a higher price while Neal wanted to get the price down as quickly as possible and get the house sold immediately. In addition, Clarissa wanted to do much more remodeling and prepping than Neal did. They compromised and wound up spending $2,000 on granite countertops and a new sink in the kitchen, plus paint for the bathrooms. Then more money was spent: on plants, a mantle, light fixtures and more. Eventually they sold the house, but not after a lot of compromising and negotiating with each other. Have you and your spouse argued over your housing situation recently? What did you argue about and was their a resolution? Labels: commentary, money, real people, work

Business With Your Spouse: A Test

CNBC show The Big Idea hosted by Donny Deutsch CNBC show The Big Idea hosted by Donny Deutsch ran a segment the other day on running a business with your spouse. On their website, they've posted a seven question test that grades how well you and your spouse would do in business. Some of the questions it asks are: Is your spouse a momentum builder? Does your spouse respect your time? and Is your spouse a good interrogator? Each question is weighted from 1-5 and the results range from: "Your Husband or wife is standing in the way of your success" to "Your relationship fosters success and your spouse gives you an entrepreneurial edge!" Would you ever run a business with your spouse or are you currently doing so? Running a business together is one of those things that could bring you closer together or tear you apart. What's your story? Labels: entertainment, money, work

Business With Your Spouse: A Test

CNBC show The Big Idea hosted by Donny Deutsch CNBC show The Big Idea hosted by Donny Deutsch ran a segment the other day on running a business with your spouse. On their website, they've posted a seven question test that grades how well you and your spouse would do in business. Some of the questions it asks are: Is your spouse a momentum builder? Does your spouse respect your time? and Is your spouse a good interrogator? Each question is weighted from 1-5 and the results range from: "Your Husband or wife is standing in the way of your success" to "Your relationship fosters success and your spouse gives you an entrepreneurial edge!" Would you ever run a business with your spouse or are you currently doing so? Running a business together is one of those things that could bring you closer together or tear you apart. What's your story? Labels: entertainment, money, work

Business With Your Spouse: A Test

CNBC show The Big Idea hosted by Donny Deutsch CNBC show The Big Idea hosted by Donny Deutsch ran a segment the other day on running a business with your spouse. On their website, they've posted a seven question test that grades how well you and your spouse would do in business. Some of the questions it asks are: Is your spouse a momentum builder? Does your spouse respect your time? and Is your spouse a good interrogator? Each question is weighted from 1-5 and the results range from: "Your Husband or wife is standing in the way of your success" to "Your relationship fosters success and your spouse gives you an entrepreneurial edge!" Would you ever run a business with your spouse or are you currently doing so? Running a business together is one of those things that could bring you closer together or tear you apart. What's your story? Labels: entertainment, money, work

Marriage Counseling May Hurt Your Credit!

On June 10, the Federal Trade Commission has sued credit card issuer CompuCredit for deceptive marketing practices. The reason is that while many credit card companies have their formula for how they adjust the interest rate or credit score, CompuCredit makes its decision on purchasing behavior, not just payment history--and does so without telling the consumer. The suit, for the most part focuses on CompuCredit's Aspire Visa, a subprime credit card for risky borrowers. The FTC claims that CompuCredit didn't properly disclose that it monitored spending and cut credit lines if consumers used their cards at certain places. Among them: tire and retreading shops, massage parlors, bars, billiard halls, and marriage counseling offices. According to this article from BusinessWeek, CompuCredit maintains that the FTC's lawsuit is without merit, and defends its practices. "Every time a consumer accesses their credit, a new decision to extend a loan is being made," says Rohit H. Kirpalani, CompuCredit's general counsel. "These scoring models are commonplace across the industry." Doesn't it seem odd that taking steps to improve or salvage your marriage would hurt your credit score? You'd think it would improve your score since married couples statistically have a higher household income. We'll keep you posted as this story develops. Labels: money, news

Marriage Counseling May Hurt Your Credit!

On June 10, the Federal Trade Commission has sued credit card issuer CompuCredit for deceptive marketing practices. The reason is that while many credit card companies have their formula for how they adjust the interest rate or credit score, CompuCredit makes its decision on purchasing behavior, not just payment history--and does so without telling the consumer. The suit, for the most part focuses on CompuCredit's Aspire Visa, a subprime credit card for risky borrowers. The FTC claims that CompuCredit didn't properly disclose that it monitored spending and cut credit lines if consumers used their cards at certain places. Among them: tire and retreading shops, massage parlors, bars, billiard halls, and marriage counseling offices. According to this article from BusinessWeek, CompuCredit maintains that the FTC's lawsuit is without merit, and defends its practices. "Every time a consumer accesses their credit, a new decision to extend a loan is being made," says Rohit H. Kirpalani, CompuCredit's general counsel. "These scoring models are commonplace across the industry." Doesn't it seem odd that taking steps to improve or salvage your marriage would hurt your credit score? You'd think it would improve your score since married couples statistically have a higher household income. We'll keep you posted as this story develops. Labels: money, news

Marriage Counseling May Hurt Your Credit!

On June 10, the Federal Trade Commission has sued credit card issuer CompuCredit for deceptive marketing practices. The reason is that while many credit card companies have their formula for how they adjust the interest rate or credit score, CompuCredit makes its decision on purchasing behavior, not just payment history--and does so without telling the consumer. The suit, for the most part focuses on CompuCredit's Aspire Visa, a subprime credit card for risky borrowers. The FTC claims that CompuCredit didn't properly disclose that it monitored spending and cut credit lines if consumers used their cards at certain places. Among them: tire and retreading shops, massage parlors, bars, billiard halls, and marriage counseling offices. According to this article from BusinessWeek, CompuCredit maintains that the FTC's lawsuit is without merit, and defends its practices. "Every time a consumer accesses their credit, a new decision to extend a loan is being made," says Rohit H. Kirpalani, CompuCredit's general counsel. "These scoring models are commonplace across the industry." Doesn't it seem odd that taking steps to improve or salvage your marriage would hurt your credit score? You'd think it would improve your score since married couples statistically have a higher household income. We'll keep you posted as this story develops. Labels: money, news

Why We Divorce

We know that budgets are getting pinched tighter every day in this economy with food prices rising, gas prices rising, the dollar value depreciating and so on. That's why it's more important than ever for you and your spouse to bond together and don't start a blame game for any financial hardship that may be rearing its head. A study by divorce360.com found that financial woes were the second most common reason for divorce behind only abuse. Just behind financial issues were sexual issues. Now may be a good time to make an appointment with your financial advisor to help weather the current economic conditions. It's better to see a financial advisor than a judge in divorce court. Labels: money, sex, study

Why We Divorce

We know that budgets are getting pinched tighter every day in this economy with food prices rising, gas prices rising, the dollar value depreciating and so on. That's why it's more important than ever for you and your spouse to bond together and don't start a blame game for any financial hardship that may be rearing its head. A study by divorce360.com found that financial woes were the second most common reason for divorce behind only abuse. Just behind financial issues were sexual issues. Now may be a good time to make an appointment with your financial advisor to help weather the current economic conditions. It's better to see a financial advisor than a judge in divorce court. Labels: money, sex, study

Why We Divorce

We know that budgets are getting pinched tighter every day in this economy with food prices rising, gas prices rising, the dollar value depreciating and so on. That's why it's more important than ever for you and your spouse to bond together and don't start a blame game for any financial hardship that may be rearing its head. A study by divorce360.com found that financial woes were the second most common reason for divorce behind only abuse. Just behind financial issues were sexual issues. Now may be a good time to make an appointment with your financial advisor to help weather the current economic conditions. It's better to see a financial advisor than a judge in divorce court. Labels: money, sex, study

How to Beat New Luggage Charge

American Airlines announced today that they'll begin charging travelers for their luggage. No, not starting with their second bag, but the first bag that travelers check-in. American Airlines will impose a $15 fee beginning June 15th. This article from MSNBC offers a few tips for how to beat the new charge. First, read your contract and make sure that AA doesn't try to charge you before June 15th. Second, carry your bag on. Obviously you'd have to pack lighter so that you could carry it on, but for a short trip it'll do. Third, flash your frequent flier card--they're exempt from the new charge. Finally, MSNBC recommends notifying the Transportation Department of your displeasure and ask them to act. Geez, as if traveling in the summer wasn't tough enough. Labels: advice, money, travel

How to Beat New Luggage Charge

American Airlines announced today that they'll begin charging travelers for their luggage. No, not starting with their second bag, but the first bag that travelers check-in. American Airlines will impose a $15 fee beginning June 15th. This article from MSNBC offers a few tips for how to beat the new charge. First, read your contract and make sure that AA doesn't try to charge you before June 15th. Second, carry your bag on. Obviously you'd have to pack lighter so that you could carry it on, but for a short trip it'll do. Third, flash your frequent flier card--they're exempt from the new charge. Finally, MSNBC recommends notifying the Transportation Department of your displeasure and ask them to act. Geez, as if traveling in the summer wasn't tough enough. Labels: advice, money, travel

How to Beat New Luggage Charge

American Airlines announced today that they'll begin charging travelers for their luggage. No, not starting with their second bag, but the first bag that travelers check-in. American Airlines will impose a $15 fee beginning June 15th. This article from MSNBC offers a few tips for how to beat the new charge. First, read your contract and make sure that AA doesn't try to charge you before June 15th. Second, carry your bag on. Obviously you'd have to pack lighter so that you could carry it on, but for a short trip it'll do. Third, flash your frequent flier card--they're exempt from the new charge. Finally, MSNBC recommends notifying the Transportation Department of your displeasure and ask them to act. Geez, as if traveling in the summer wasn't tough enough. Labels: advice, money, travel

Shoe Prices Going Up

With Sex and the City about to hit big screens, which will surely put high fashion shoes back in the spotlight, this article from the Wall Street Journal says shoe makers are raising the price tag, bucking a decade-long trend of declining prices. So why the increase? For one, the article says higher costs in China, which make about 85 percent of the shoes sold in the U.S.. Another reason is the weak dollar, which affects the price of shoes coming from European makers. It only makes sense then that the article suggests that price increases would follow suit for handbags, belts and other leather accessories coming from China. Overall, the rising shoe prices high- and low-end brands. Labels: fashion, money

Shoe Prices Going Up

With Sex and the City about to hit big screens, which will surely put high fashion shoes back in the spotlight, this article from the Wall Street Journal says shoe makers are raising the price tag, bucking a decade-long trend of declining prices. So why the increase? For one, the article says higher costs in China, which make about 85 percent of the shoes sold in the U.S.. Another reason is the weak dollar, which affects the price of shoes coming from European makers. It only makes sense then that the article suggests that price increases would follow suit for handbags, belts and other leather accessories coming from China. Overall, the rising shoe prices high- and low-end brands. Labels: fashion, money

Shoe Prices Going Up

With Sex and the City about to hit big screens, which will surely put high fashion shoes back in the spotlight, this article from the Wall Street Journal says shoe makers are raising the price tag, bucking a decade-long trend of declining prices. So why the increase? For one, the article says higher costs in China, which make about 85 percent of the shoes sold in the U.S.. Another reason is the weak dollar, which affects the price of shoes coming from European makers. It only makes sense then that the article suggests that price increases would follow suit for handbags, belts and other leather accessories coming from China. Overall, the rising shoe prices high- and low-end brands. Labels: fashion, money

Why These Couples Won't Get Tax Rebates

An AP article has highlighted a segment of the married population that won't be getting their stimulus check from Uncle Sam. So who is this married group? They are couples where one spouse is not a U.S. citizen. So even if you are a U.S. citizen, if you filed your taxes jointly, you won't receive a stimulus check because both have to have a Social Security card. It's estimated that hundreds of thousands of married couples fall into this category, and this article highlights soldiers who have married foreigners as part of that group. The article goes on to discuss how the IRS didn't clarify this rule on it's website until April 14th. The couples could have filed individually, but as the article points out, the benefits of filing jointly would most likely outweigh the $600 a qualifying individual would receive. Read the full article here.Labels: money, news, real people

Why These Couples Won't Get Tax Rebates

An AP article has highlighted a segment of the married population that won't be getting their stimulus check from Uncle Sam. So who is this married group? They are couples where one spouse is not a U.S. citizen. So even if you are a U.S. citizen, if you filed your taxes jointly, you won't receive a stimulus check because both have to have a Social Security card. It's estimated that hundreds of thousands of married couples fall into this category, and this article highlights soldiers who have married foreigners as part of that group. The article goes on to discuss how the IRS didn't clarify this rule on it's website until April 14th. The couples could have filed individually, but as the article points out, the benefits of filing jointly would most likely outweigh the $600 a qualifying individual would receive. Read the full article here.Labels: money, news, real people

Why These Couples Won't Get Tax Rebates

An AP article has highlighted a segment of the married population that won't be getting their stimulus check from Uncle Sam. So who is this married group? They are couples where one spouse is not a U.S. citizen. So even if you are a U.S. citizen, if you filed your taxes jointly, you won't receive a stimulus check because both have to have a Social Security card. It's estimated that hundreds of thousands of married couples fall into this category, and this article highlights soldiers who have married foreigners as part of that group. The article goes on to discuss how the IRS didn't clarify this rule on it's website until April 14th. The couples could have filed individually, but as the article points out, the benefits of filing jointly would most likely outweigh the $600 a qualifying individual would receive. Read the full article here.Labels: money, news, real people

Financial Risk Taking Linked to Sex

A new study by a Northwestern University finance professor found A new study by a Northwestern University finance professor found that when men were shown erotic images, they were more likely to make a large financial gamble than when they were shown scary or neutral images--like a snake or stapler. The study took brain scans of the participants and found the brain was stimulated in the same area with both money and sex. A former commodities floor trader says the connection makes a lot of sense considering the euphemisms used on the trading floor, such as "massaging the market." Vegas makes so much sense, doesn't it? Labels: money, sex, study

Financial Risk Taking Linked to Sex

A new study by a Northwestern University finance professor found A new study by a Northwestern University finance professor found that when men were shown erotic images, they were more likely to make a large financial gamble than when they were shown scary or neutral images--like a snake or stapler. The study took brain scans of the participants and found the brain was stimulated in the same area with both money and sex. A former commodities floor trader says the connection makes a lot of sense considering the euphemisms used on the trading floor, such as "massaging the market." Vegas makes so much sense, doesn't it? Labels: money, sex, study

Financial Risk Taking Linked to Sex

A new study by a Northwestern University finance professor found A new study by a Northwestern University finance professor found that when men were shown erotic images, they were more likely to make a large financial gamble than when they were shown scary or neutral images--like a snake or stapler. The study took brain scans of the participants and found the brain was stimulated in the same area with both money and sex. A former commodities floor trader says the connection makes a lot of sense considering the euphemisms used on the trading floor, such as "massaging the market." Vegas makes so much sense, doesn't it? Labels: money, sex, study

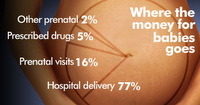

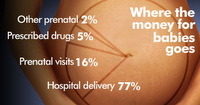

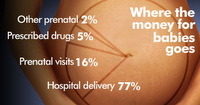

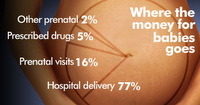

How Much Does a Pregnancy Cost?

The numbers are a few years old, but interesting nonetheless. In 2004, the average uncomplicated pregnancy cost was $7,539 according to numbers from the Healthcare Cost and Utilization Project. So where is the money going to? 77 percent went to pay for the hospital delivery ($5,819), 16 percent went to prenatal visits ($1,178), 5 percent went to prescribed drugs ($392), and 2 percent went to other prenatal stuff ($151). Have you found that your pregnancy cost more or less than what they're reporting. Again, this data is going on four years old. Labels: money, pregnancy, study

How Much Does a Pregnancy Cost?

The numbers are a few years old, but interesting nonetheless. In 2004, the average uncomplicated pregnancy cost was $7,539 according to numbers from the Healthcare Cost and Utilization Project. So where is the money going to? 77 percent went to pay for the hospital delivery ($5,819), 16 percent went to prenatal visits ($1,178), 5 percent went to prescribed drugs ($392), and 2 percent went to other prenatal stuff ($151). Have you found that your pregnancy cost more or less than what they're reporting. Again, this data is going on four years old. Labels: money, pregnancy, study

How Much Does a Pregnancy Cost?

The numbers are a few years old, but interesting nonetheless. In 2004, the average uncomplicated pregnancy cost was $7,539 according to numbers from the Healthcare Cost and Utilization Project. So where is the money going to? 77 percent went to pay for the hospital delivery ($5,819), 16 percent went to prenatal visits ($1,178), 5 percent went to prescribed drugs ($392), and 2 percent went to other prenatal stuff ($151). Have you found that your pregnancy cost more or less than what they're reporting. Again, this data is going on four years old. Labels: money, pregnancy, study

10 Destinations Where the Dollar is Strong

The economy is struggling, haven't heard a thing about it. Okay, you know that's a lie. If you've glanced at a news website or newspaper in that last month or so, you'd know that the U.S. dollar is getting its butt kicked when compared to the Euro and other currency. However, there are some places in this world where couples can go and still get a good bang for their buck. Concierge.com put together a list of 10 destinations where the dollar is still strong, including Barbados; Ho An, Vietnam; Warsaw, Poland; Jordan and others. If you want to stay out of foreign territory look to Santa Ynez Valley, California according to the website. Click here to read the complete list, with pictures.Labels: money, travel

10 Destinations Where the Dollar is Strong